The $20 Transfer Problem: Why Small Cross-Border Payments Still Cost 36% in Fees

5th February, 2026

Author:

- Anurag Jain, CEO

Category: Trends and Insights

In my last post, I shared a story from nearly 22 years ago—when I had to pay $14 to send $20 from Las Vegas to an auto garage in New Jersey. That moment stayed with me and ultimately led to the creation of Prepay Nation.

Most of us in the cross-border industry know that the global remittance market exceeds $700 billion annually, yet small transfers under $50 still face fees averaging 15-40% of the transaction value.

Recently, while sending $1,000 to my own bank account in India through a reputed well-known online remittance company, I paused and asked a simple question:

What would it cost today to send just $20 from Philadelphia to New Delhi?

So, I checked.

The answer surprised me—not because it was unusual, but because it was still so painfully familiar.

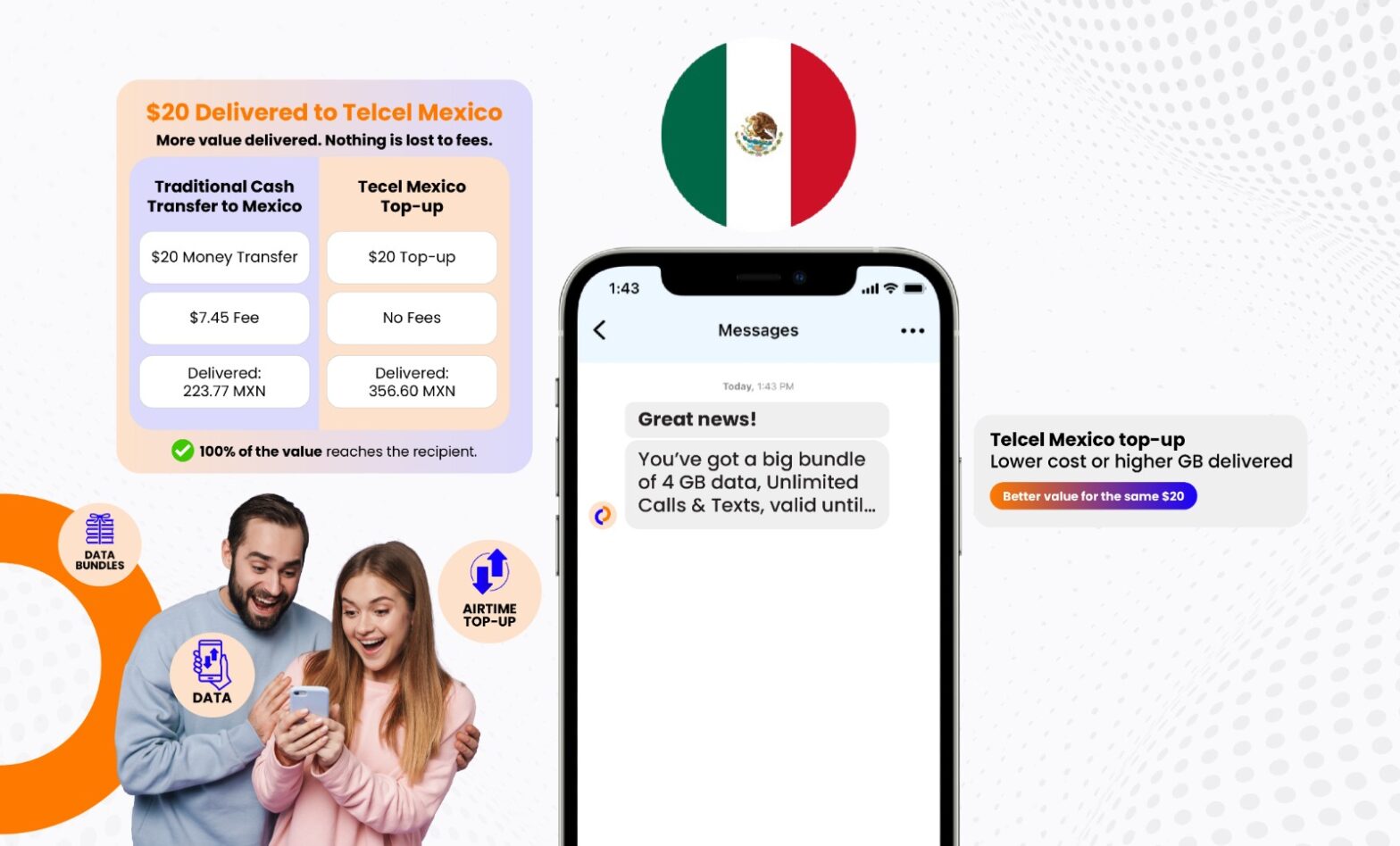

As you can see in the screenshot below, a well-known and reputable remittance provider would charge $7.23 in fees to send $20—that’s over 36% of the transaction value.

Despite decades of innovation in payments, digital wallets, and new “rails,” small-value international transfers remain disproportionately expensive. The system works reasonably well for large amounts—but breaks down completely for people who need to send $10, $20, or $30 to support their families.

And those people are everywhere.

It makes me sad—but it also makes me incredibly proud of the work we do at Prepay Nation.

We enable real-time, cross-border transfers of small values, often at zero cost to the consumer— and in many cases, at negative cost. Even more importantly, everyone in the value chain still makes money by serving customers better, not by penalizing them for sending small amounts.

Small-value transfers don’t have to be cash. Value can be delivered instantly as:

• Mobile airtime or data

• Grocery and essential goods vouchers

• Gaming or digital content credits

This is what financial inclusion actually looks like—not buzzwords, but practical solutions for real people.

Twenty years later, the $20 saga continues. At Prepay Nation, we’re making sure the next chapter finally changes the ending

I see many thoughtful posts from people working hard to bring remittance costs down—and it’s inspiring to watch real progress.

Beyond value-based transfers like those at Prepay Nation, what solutions have you seen actually work for small-value cross-border payments?

#CrossBorderPayments #FinancialInclusion #RemittanceInnovation #Fintech #PrepayNation

Author

- Anurag Jain, CEO